Cross-border

economic

development

28

Territory portraits: economic development on different borders

It may be noted that for territorial authorities, different provisions apply to the

tax on the income of cross-border workers in the Jura Arc region (Cantons

of Bern, Neuchâtel, Jura and Vaud; as well as the Cantons of Basel-City,

Basel-Country, Solothurn and Valais) and the Canton of Geneva. In the

first case, employees are taxed in France and the French authorities then

pay 4.5% of the cross-border workers’ gross salaries back to the Swiss

tax authorities.

38

In the second case, the cross-border workers are taxed

at source and the Swiss authorities pay back 3.5%of the total wage bill to

France (these amounts are then transferred from the State to the relevant

territorial authorities where the cross-border workers are resident – the Ain

and Haute-Savoie Departments and the relevant municipalities).

39

Economic fabric

The economic fabric is very varied along the whole of the border. In

the Jura Arc region, on both sides of the border, we see firms (SMEs)

that specialise mainly in microtechnology and watchmaking (with an

automotive hub around Belfort-Montbéliard). This predominantly industrial

38

11 April 1983 Agreement between the Swiss Federal Council and the French Republic

concerning the taxing of salaries of border workers, applicable in the Cantons of Bern,

Solothurn, Basel-City, Basel-Country, Vaud, Valais, Neuchâtel and Jura.

39

29 January 1973 Agreement between the Swiss Federal Council acting on behalf of the

Republic and Canton of Geneva and the government of the French Republic concerning

financial compensation with respect to cross-border workers working in Geneva.

fabric is dependent on clients from outside the region. Greater Geneva,

which is a major economic centre, has a more diverse and more tertiary

economy, as is typical of large European metropolises. The border

between France and the Valais region, a mainly mountainous, rural

area, is characterised by an economy that is based both on tourism

(particularly in the winter) and industry, which is very varied in the valleys:

pharmaceuticals, micromechanics, electronics, etc.

Ì

Ì

In the Jura Arc region

, many French SMEs are subcontractors

for Swiss watchmakers. This is not the case the other way around:

large French car companies do not subcontract to the Swiss side

(Swiss subcontractors work with German car manufacturers).

The potential complementarities, especially in the area of

Back plan, Mall of the Swiss banner “Migros” installed on the Pays de Gex - Val

Thoiry territory, on the French side

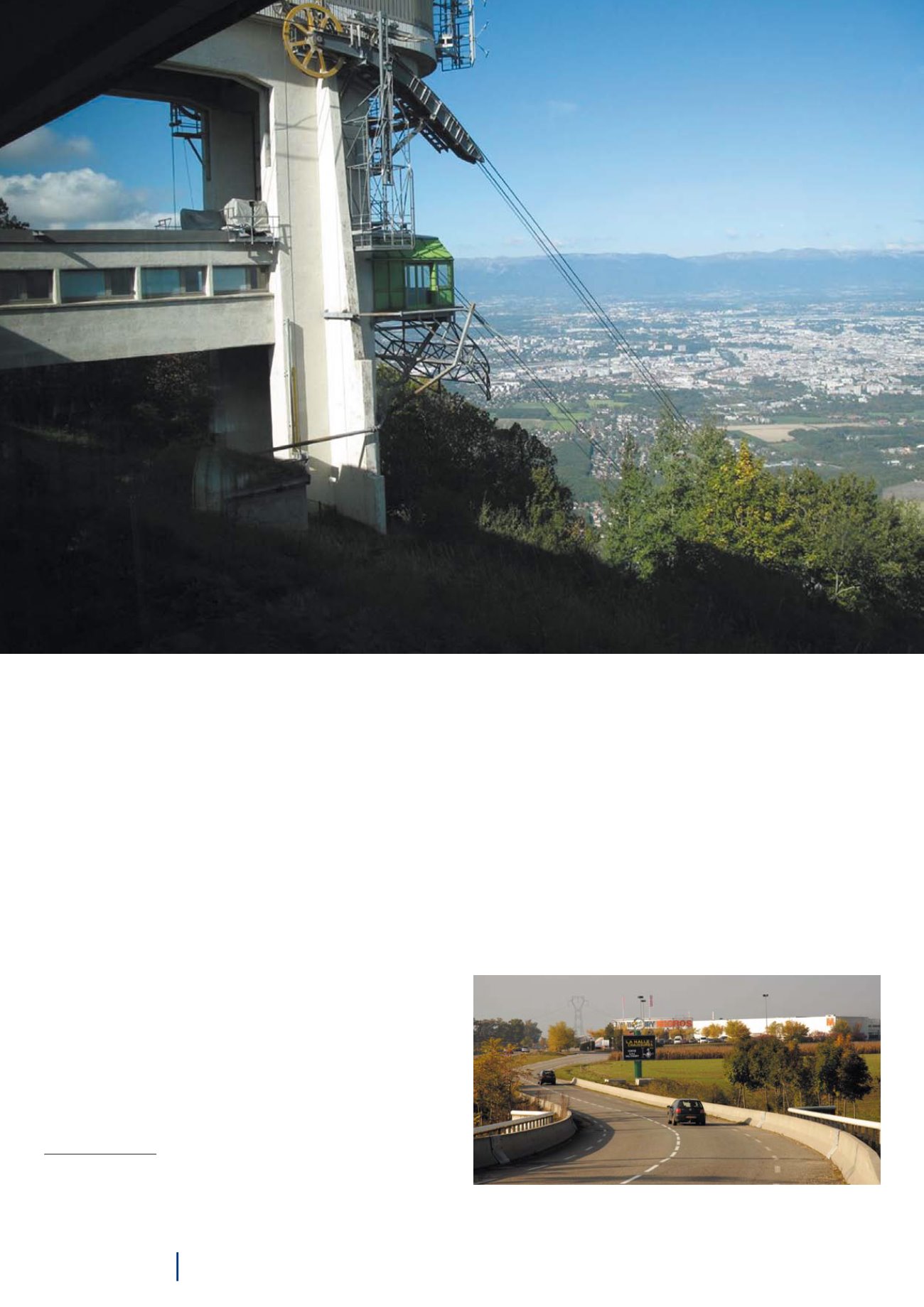

Geneva area seen from Mount Salève in France

© GLCT du Grand Genève

© Communauté de communes du Pays de Gex