Cross-border

economic

development

31

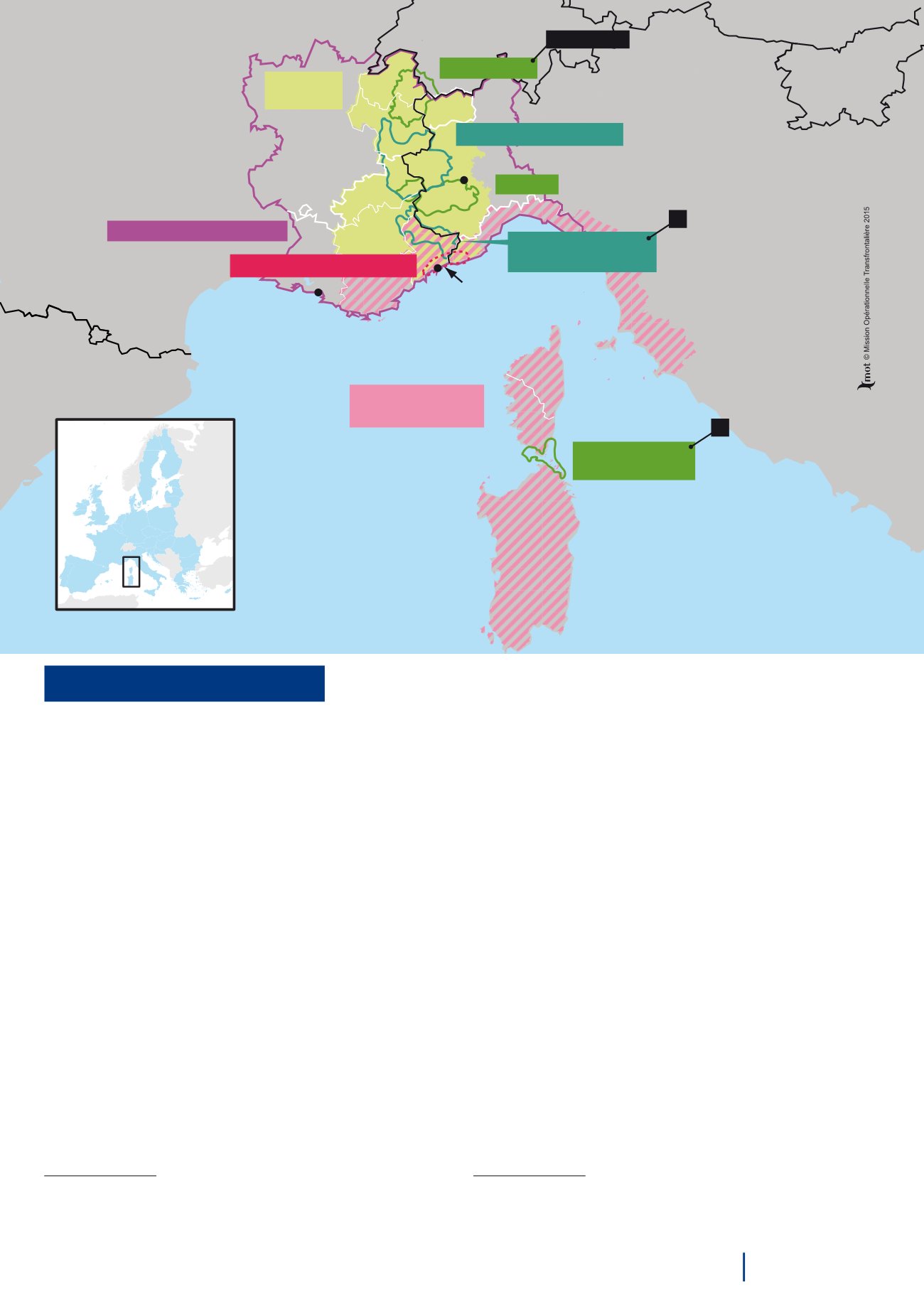

Territory portraits: economic development on different borders

France - Italy - Monaco

Comparison of framework

conditions

Framework conditions are fairly similar between France and Italy: GDP

per capita in terms of purchasing power, with the European average

(27 countries) giving the base of 100, stood at 98 for Italy in 2013 and

108 for France.

50

Businesses are taxed at one third of their profits in

France

51

and at 27.5% in Italy. After Germany and France, Italy is the

third-largest economy in the euro area. The two countries are one

another’s second trading partner.

The Principality of Monaco only taxes companies which generate more

than 25% of their profits outside the principality,

52

at a rate of 33.3%.

Apart from this, no tax is applied, neither on companies nor on natural

persons. Monaco has signed just one bilateral tax agreement, which is

50

Source: Eurostat.

51

Up to €38,120 profit, a reduced rate of 15% is applied.

52

As well as companies whose activity in Monaco consists in collecting revenue from patents or

royalties on literary or artistic property.

with France. This allows the taxation of French residents in Monaco as

though they were within French territory. In addition, the same level of

VAT is charged in France and Monaco. This agreement therefore serves

to limit the tax differences between France and Monaco.

Territories close to the border face particular constraints with respect to

land: from the coast up along the Roya Valley, on both the French and

Italian sides, available land is very scarce as, in addition to the limitations

of the physical geography, a large part of the territory is a protected

natural area.

53

With urbanisation having reached its limit (no more land

available), there are strong tensions between demand for housing for

working people, houses bought by retired people wanting to settle in

the area and tourism (rented accommodation and second homes).

53

Available land is particularly scarce in the coastal area (32% of artificially-constructed land as

compared to less than 4% in the middle and upper parts of the region), as well as in the whole

of the Menton-Roya Valley employment area, 93% of which consists of natural spaces that are

difficult to build on (geography and protection of the countryside).

Portrait of a territory

Parc Marin International

des Bouches de Bonifacio

INTERREG

Italy-France Maritime

Franco-Italo-Monegasque Riviera

Haute-Savoie

Savoie

Hautes-

Alpes

Alpes-de-

Haute-Provence

Var

INTERREG

ALCOTRA

RHÔNE-ALPES

PACA

PACA : Provence-Alpes-Côte d’Azur

LIGURIA

AOSTA VALLEY

PIEDMONT

CORSICA

SARDINIA

TUSCANY

Alpes-

Maritimes

Alps–Mediterranean Euroregion

Conference of the High Valleys

FRANCE

SWI TZERLAND

MONACO

I TALY

Mont Viso

Mont Blanc Area

International Marine

Park of Bonifacio

EGTC

Marseille

Nice

Turin

European Park of

Alpi Marittime-Mercantour

EGTC ( under creation )

EGTC

Haute-Corse

Corse

du Sud