Cross-border

economic

development

27

Territory portraits: economic development on different borders

France-Switzerland

Comparison of framework

conditions

Framework conditions in France and Switzerland are significantly different,

both from a financial and administrative point of view. Companies in

Switzerland are taxed less (taxes vary depending on the canton and the

municipality, corporation tax is lower by about ten percentage points,

there is no equivalent tax to France’s territorial economic contribution

(CET), salaries are higher but social security contributions are lower).

37

In

addition, they are less complex administratively (calculation of salaries,

accounting practices, tax returns). Rents for business property are

similar, or sometimes lower, in Switzerland for small businesses that

do not need much space, especially in Greater Geneva (many premises

are available for rent in the Canton of Geneva).

37

The “standard” corporation tax rate is around 33% in France (though numerous tax credits

can reduce this rate, or a reduced tax rate can be applied in certain circumstances, in

particular for SMEs). In Switzerland, the federal tax rate is 8.5% for capital companies; by

adding a variable rate for the canton and municipality, the overall tax rate can fluctuate

between about 21% and 24%. See the EUREX study on this subject: “Avantages comparés

pour l’implantation d’activités économiques en France et en Suisse (Genève/Vaud)”

(Comparative advantages for the establishment of economic activities in France and

Switzerland (Geneva/Vaud)), carried out in 2010 for the Projet d’agglo franco-valdo-genevois

(France-Vaud-Geneva conurbation project), and available in French at:

www.med74.fr/filemanager/download/397

Swiss households pay higher income tax than those in France and

employees pay directly for a large proportion of their social security

cover (sick pay, pension). Given the higher salaries, but also a higher

cost of living and private social security insurance in Switzerland, for

an equivalent job, the standard of living is comparable for a French and

Swiss household. Cross-border working, when it makes it possible to

benefit from a Swiss salary and the French cost of living, is extremely

advantageous for employees and also benefits Swiss companies, which

are able to attract qualified workers, of which there is a shortage in

Switzerland. The difference in cost of living also explains the widespread

practice by Swiss residents of making purchases in France (development

of retailers on the border, establishment of Swiss retailers on the French

side of the border).

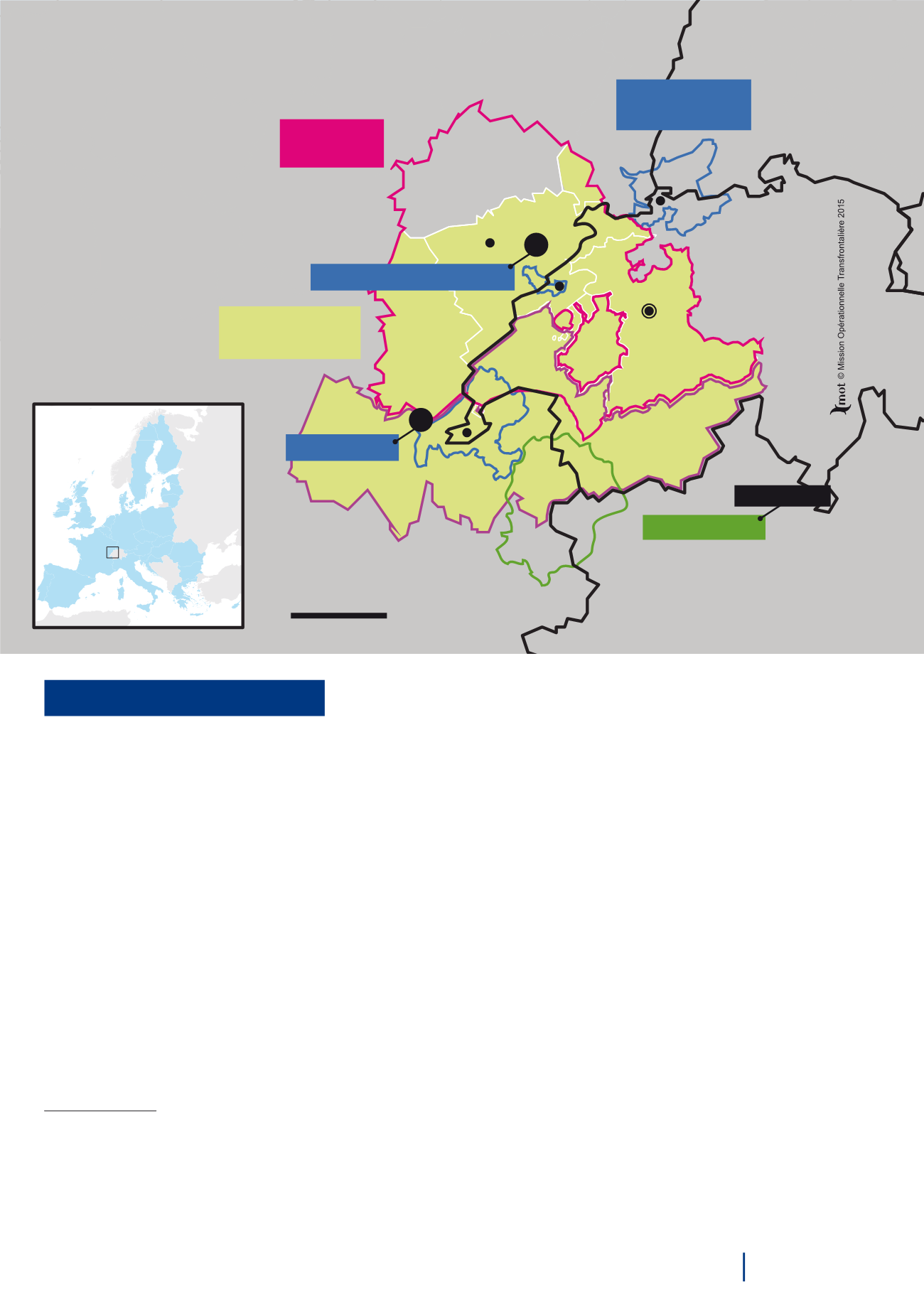

Portrait of a territory

FRANCE

GERMANY

50 km

Haute-Saône

Basel

INTERREG

France-Switzerland

FRANCHE-COMTÉ

Geneva

Trans-Jura

Conference

Doubs

Jura

Territoire

de Belfort

VD

NE

BE

JU

SWI TZERLAND

Greater Geneva

BE : Berne

NE : Neuchâtel

JU : Jura

VD: Vaud

Doubs Urban Agglomeration

Bern

Besançon

La Chaux de Fonds

LGCC

LGCC

Mont Blanc Area

EGTC ( under creation )

Trinational

Eurodistrict Basel