Cross-border

economic

development

76

Cross-cutting themes in cross-border economic development

The great majority regional ERDF-ESF 2014-2020 OPs

provide for

the use of financial instruments, particularly for thematic objectives 1,

3 and 4 and in various forms: direct investment in share capital (equity

investment, transfer funding, start-up funding, third-party funding/

investment, maturation funds, seed funding, venture capital, development

capital), loans (loan funds, zero-interest loans, preferential loans, equity

loans, honour loans, micro-credit funds, repayable advances and

subsidised loans), guarantees and other sources (crowdfunding platforms,

European financial instruments, share acquisition funds, property leases,

funds of funds, etc.).

115

The need to reach this target group requires synergies between sources

of funding that go beyond the framework of structural funds. The

objectives of Europe 2020, coupled with those of cohesion policy for

2014-2020, require better coordination between

thematic financing

(research, innovation and development, entrepreneurial capacity building,

etc.) and the ESIF to support smart, sustainable and inclusive growth.

The two main European programmes for supporting innovation/

research

, international development of businesses and industrial

cooperation for the 2014-2020 period, Horizon 2020 (formerly the

Framework Programme for Research and Technological Development –

FPRTD) and COSME (formerly CIP – Framework Programme for

Innovation and Competitiveness), already contribute to a complementary

approach to sustainable support to businesses:

Ì

Ì

Horizon 2020

specifically targets risks related to research/

innovation for innovative SMEs in their start-up and expansion

phases (feasibility of the research and innovation project, financing

and support for marketing).

Ì

Ì

COSME

has extended its scope of action to include all businesses

in their process of development, and even transfer, on the single

market, particularly through the Enterprise Europe Network (EEN),

116

and has implemented tools such as a guide

117

and a portal to

support SMEs’ internationalisation.

118

Ì

Ì

In addition to these two major programmes there is a complementary

programme to Horizon 2020,

EUREKA

, which takes a more

bottom-up and flexible approach, requiring an initiative from

at least two businesses rather than more cumbersome cyclical

calls for proposals.

115

Europ’Act, Seminar for the launch of the 2014-2020 programme of European funds,

Montpellier, 14 November 2014.

116

European Commission,

Enabling synergies between European Structural and Investment

Funds, Horizon 2020 and other research, innovation and competitiveness-related Union

programmes.

http://ec.europa.eu/regional_policy/sources/docgener/guides/synergy/ synergies_en.pdf117

Practical guide to doing business in Europe

,

http://europa.eu/youreurope/business/index_ en.htm118

The portal can be accessed at:

https://webgate.ec.europa.eu/smeip/National funding bodies and

funding from territorial

authorities

While European programmes are a not insignificant source of funding

for SMEs and cross-border economic development initiatives, national

and local authorities also contribute to supporting the development and

competitiveness of businesses and territories. Reforms have recently

been implemented in France to strengthen mechanisms for providing

financial support to SMEs.

Ì

Ì

Bpifrance

proposes a “one-stop shop” coordinated response

to the financing needs of businesses throughout their lifecycle.

Innovation is the priority target of Bpifrance actions. These range

from support for R&D and the start-up phases of innovative

projects, to increasing businesses’ own funds to support

exports in close collaboration with Business France. Bpifrance’s

organisational structure of 24 regional directorates, which are

charged with defining action plans at the regional level reflects

the desire to provide funding that most closely corresponds to

local specificities and strategic sectors.

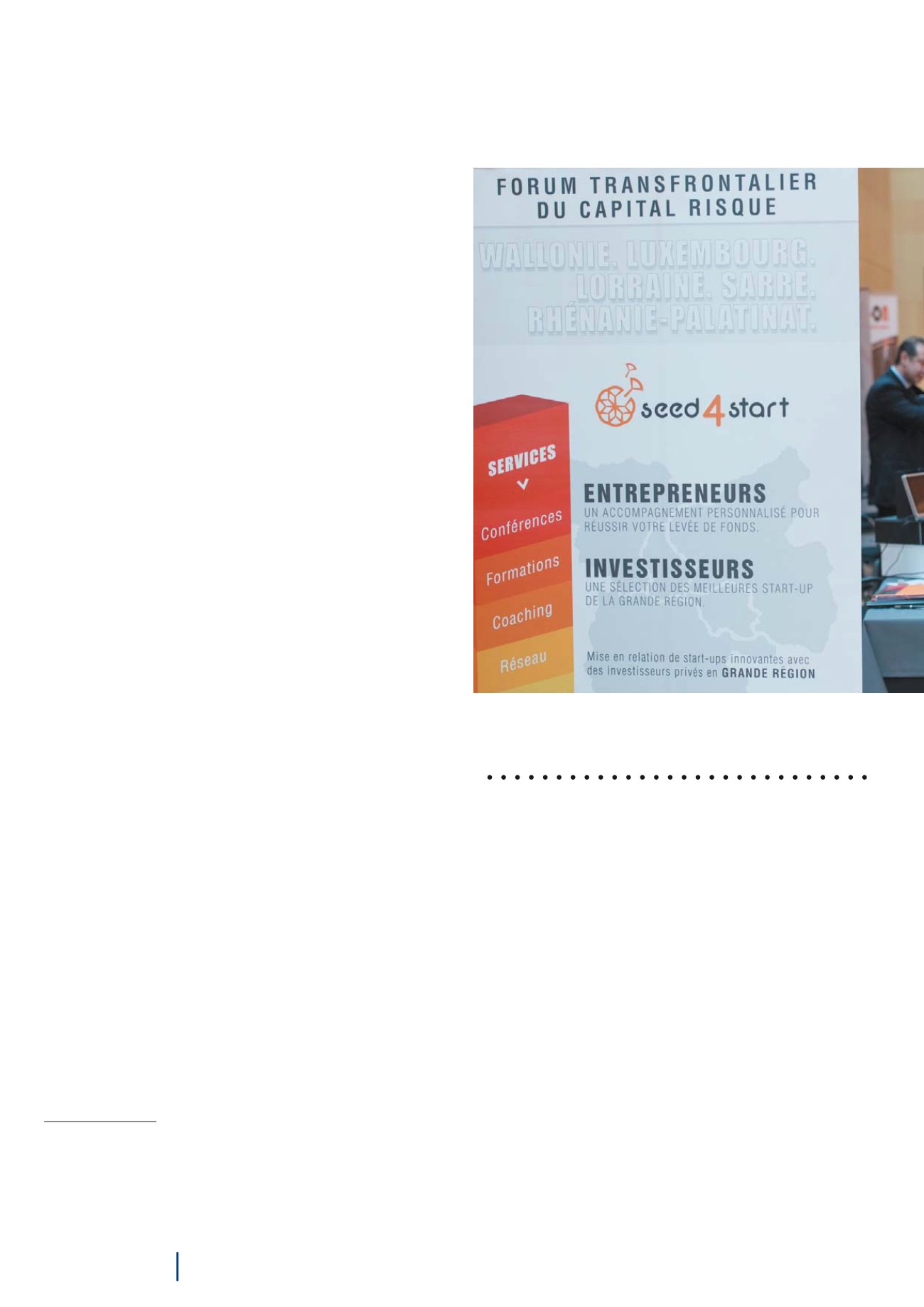

© Projet Seed4Start

Seed4Start project, in the Greater Region