Cross-border

economic

development

43

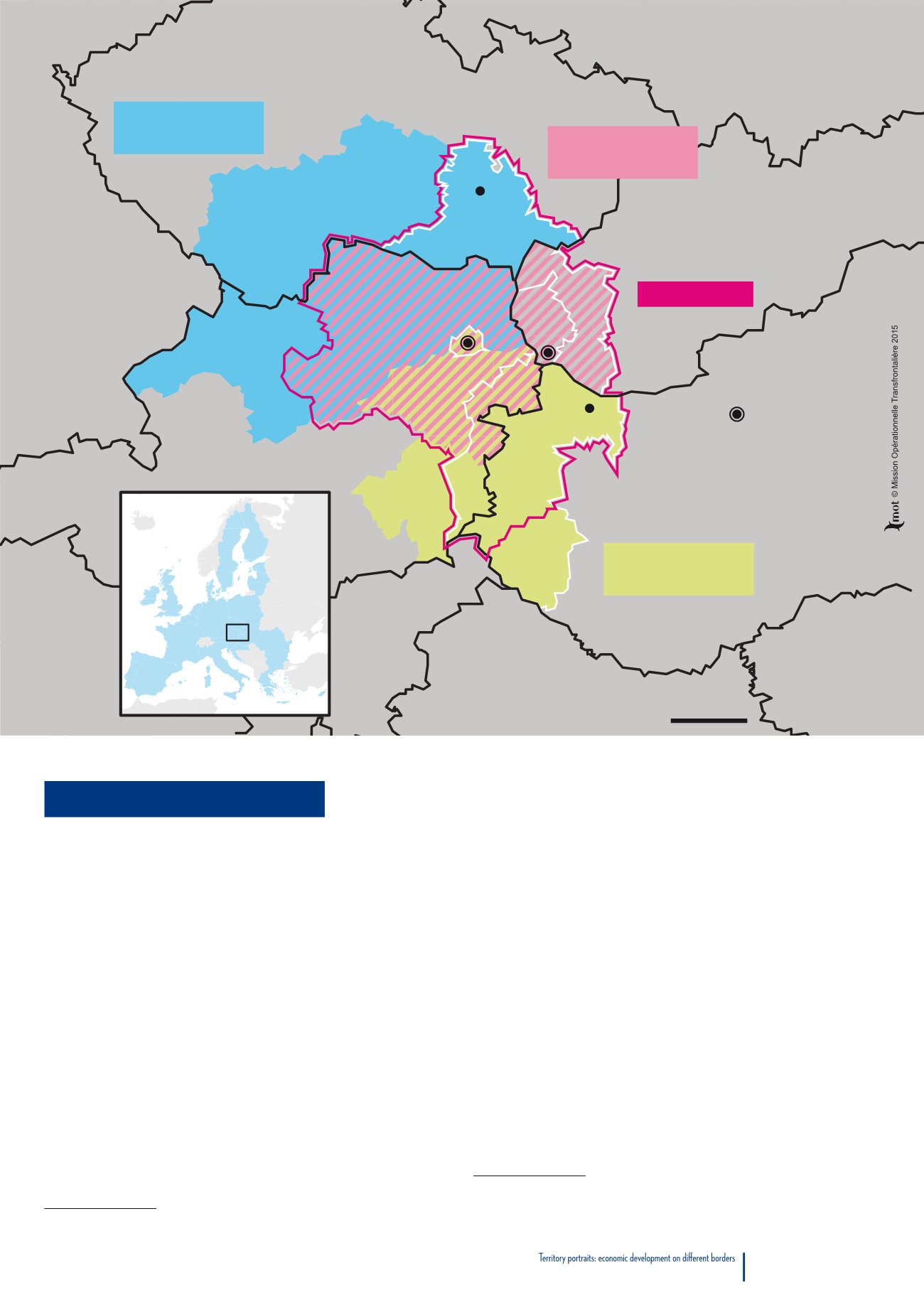

CZECH REPUBL IC

AUSTRIA

SLOVAKIA

HUNGARY

Brno

Györ

Budapest

SOUTH MORAVIA

Bratislava

TRNAVA

GYÖR-MOSON

-SOPRON

LOWER AUSTRIA

BURGEN-

LAND

Vienna

50 km

Centrope Region

INTERREG

Austria-Hungary

INTERREG Autria -

Czech Republic

INTERREG

Austria-Slovakia

Vienna - Bratislava

and neighboring regions

Comparison of framework

conditions

Framework conditions are fairly different between Austria and its

neighbours which joined the European Union in 2004: GDP per capita

in terms of purchasing power standards, with the European average (27

countries) giving the base of 100, stood at 129 for Austria in 2013, 76

for Slovakia and 80 for the Czech Republic.

78

There is a big differential

78

Source: Eurostat. Hungary stands at 67. As a comparison, France is at 108.

in terms of wages, with a ratio of around 1:3 with respect to the average

national wage. Regarding taxation, companies are also taxed less in

Slovakia,

79

which has led Austrian firms to set up subsidiaries in, or

even relocate to, Slovakia (with the same phenomenon occurring from

Slovakia to Hungary). Cross-border work is expanding quite strongly

in the area of support services to individuals, in Austria: the ageing

population has led to an increase in elderly people’s need for care and

the wage differential has encouraged many people (around 60,000

Czechs and Slovaks) to cross the Austrian border to take up these jobs.

79

The corporate income tax rate is 19% in the Czech Republic and Hungary (with a reduced

rate of 10% in Hungary if turnover is not above 500 million forints), 23% in Slovakia and 25%

in Austria. However, Austria has higher payroll taxes, while Slovakia grants tax credits that

encourage business creation with foreign financing.

Portrait of a territory