Cross-border

economic

development

39

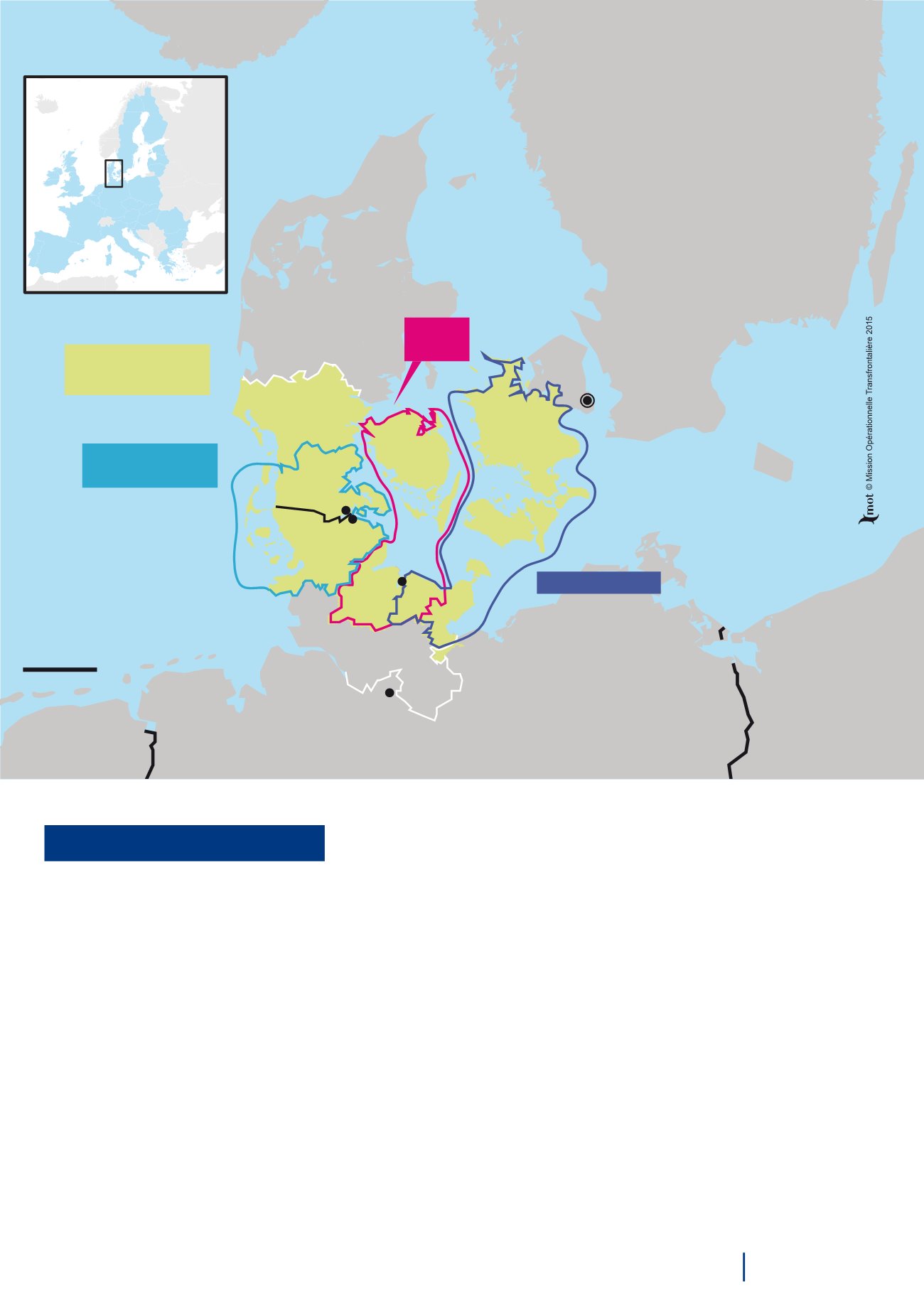

Territory portraits: economic development on different borders

Denmark -Germany

Comparison of framework

conditions

Framework conditions do not differ significantly between Germany and

Denmark. Corporation tax amounts to 25% in Denmark compared with

15% in Germany, but the tax on industrial and commercial activities

(

Gewerbesteuer

) also of around 15% must be added to this, which

rebalances tax burden levels for businesses. However, hourly labour

costs are nearly twice as high on the Danish side, where wages are

generally around 20% higher (or even more depending on the sector).

On the other hand, labour legislation is more flexible.

With respect to the price of property, this is higher in Denmark because

there is less land available for building. The German towns situated near

to the border, such as Flensburg, have therefore proved particularly

advantageous as locations for businesses wishing to develop their

activities across both markets. Moreover, many Danish firms choose

to locate on the German side in order to be closer to the Hamburg

conurbation.

As regards the general context for doing business, investors tend to

consider the German system too bureaucratic, with many procedures

having to be validated by regulatory acts with the involvement of a

notary. Denmark is much less demanding in this respect, which makes

transactions easier.

Portrait of a territory

GERMANY

DENMARK

North Sea

Baltic Sea

SWEDEN

Flensburg

Padborg

Copenhagen

Hamburg

SCHLESWIG-

HOLSTEIN

Region Sønderjylland

-Schleswig

SYDDANMARK

Fyns Amt /

K.E.R.N.

Kiel

INTERREG Germany -

Denmark

SJÆLLAND

HOVED-

STADEN

Fehmarnbelt Region

50 km