Project factsheets

Seed4Start

98

Cross-border

economic

development

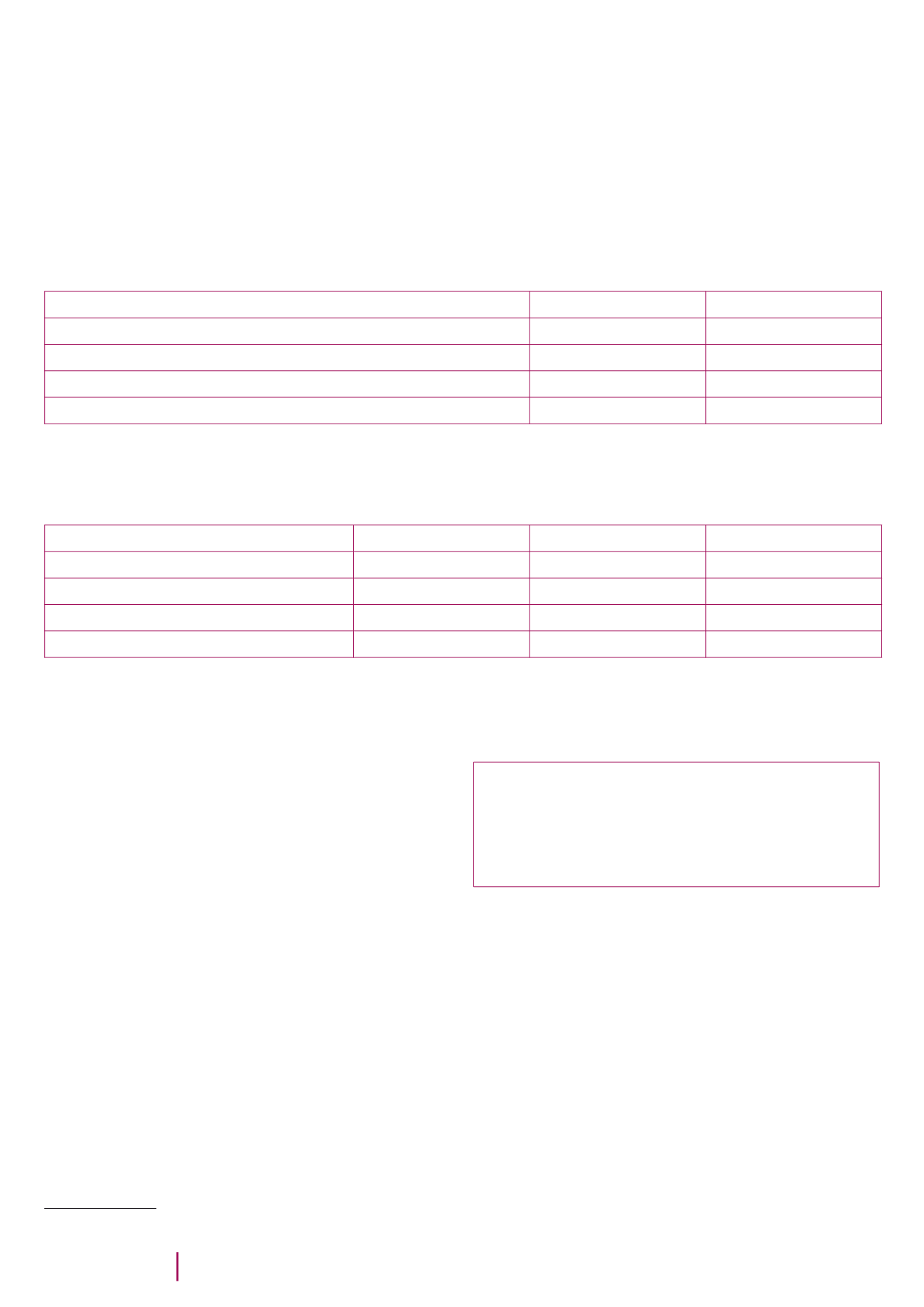

A few figures for the first two forums in 2012 and 2013:

135

Selection of projects

2012 forum

2013 forum

Applications

98

118

Candidates chosen at the pre-selection stage

60

49

Start-ups pre-selected for training

34

29

Start-ups selected for “Pitching Days”

20

20

Profile of projects presented

2012 forum

2013 forum

Total

Total amount sought

€10.5

€6.2

€16.7

Businesses in development phase

12

9

21

Businesses in commercialisation phase

8

11

19

Jobs ultimately created

82

109

191

135

Source :

http://www.seed4start.org/fr/entrepreneursTo what extent can this good practice be

adopted in other cross-border territories?

Financial support to SMEs is a problematic area for cross-border

cooperation programmes since the extremely strict State aid

regulations greatly restrict businesses’ abilities to benefit from

European funds. However, public stakeholders (territorial authorities,

investment banks, consular chambers, etc.) wish to address this

issue in their strategic thinking and operational projects. Private

equity funds are therefore emerging on all of the EU’s borders as

a possible solution to support (through financial, tax and legal

expertise, etc.) and provide private finance for economic activity in

cross-border territories.

It should be noted that a similar initiative has been implemented on

the French-Belgian border, with co-financing from the INTERREG

IV A France-Wallonia-Flanders programme: the French-Walloon

Business Angels Platform.

Pour plus d’informations:

http://www.seed4start.org/Contact:

Frédérique GUETH

Manager Business Initiative asbl

Luxembourg Chamber of Commerce

frederique.gueth@cc.lu+ 352 423 939 272